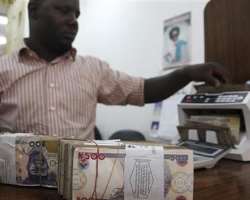

BANKING THE UNBANKED NIGERIANS

According to news report, only 21 million Nigerians have bank accounts. This is pathetic because, in a nation of about 167 million people, only 12.6 percent of the populations have bank accounts. At the global stage, out of the 7 billion people on earth, it is just 2.5 billion people that do not have bank accounts. According to World Bank report: “Three quarters of the worlds poor do not have a bank account; not only because of poverty, but also because of the cost, travel distance, and amount of paper work involved in opening one’.

There are about 5,797 bank branches nation wide, and there are about 9,958 Automated Teller Machines. What this means is that, for every 28,808 Nigerians, there is one branch of a bank, and for every 16,770 Nigerians, there is one ATM. Going by the Central Bank of Nigeria’s projection of increasing the number of bank branches from 5,797 to 10,000 branches by the year 2020, and equally increasing the number of Automated Teller Machines from 9,958 to 62,440 ATMs by the same year, what is on the lips of many Nigerians is that, will this number be enough to make at least 50 percent of the population users of bank accounts? However, going by the 2006 census figure which puts our total population at 140 million people with an annual growth rate of 3.2 percent, it is expected that by the year 2020, the Nigerian population would be 202,720,000 million people. By this time, the number of our bank branches and Automated Teller Machines would be 10,000 and 62,440 respectively. If the CBN succeeds in meeting the target, it then means that, for every 20,272 Nigerians, there would be one branch of a bank, and for every 3,246 Nigerians, there would be one ATM Centre.

Similarly, with the current number of savings account users put at 21 million, which represents approximately 12.6 percent of the population, it then means that, by the year 2020, which the CBN has projected to increase the number of savings account users from 21 million to 63 million, the total number of savings account users would increase from 12.6 percent to about 31 percent. What this means is that, by the year 2020, the number of Nigerians without bank accounts will still be higher than those with bank accounts. And according to World Bank report: “Those without access to formal banking often have to rely on money lenders who often charge high fees…the unbanked are also less likely to start their own business or insure themselves against unexpected events”.

In a country where access to formal credit is 2 percent, and loan account ratio is 15 per 1000 people, how then do we reduce the alarming rate of youth unemployment and poverty in the country? The Malaysian loan account ratio is 963 per 1000. The same World Bank report says: “Financial inclusion or being banked can be transformative, as it allows poor people to build a more secure future. The ability to save and borrow allows them to build their assets, start a business, invest in education, establish a credit rating, and eventually own a home”. How can the unbanked Nigerians achieve all this? Even among the bankable adults, how can they

actualize their dreams of starting a business and owning a home when the lending rate is five times higher than the interest rate that banks pays? Though it varies from bank to banks! On the global stage, 61 percent of account holders use it to receive payment from their employers. However, with the new banking policy directed to commercial banks by the Central Bank on the minimum interest rate of 3 percent for savings account and the maximum lending rate of 20 percent should be monitored by the apex bank! Before the new policy, the highest interest rate was 3.5 percent which only a commercial bank pays! The rest was between 1 percent and 2.5 percent, except 3 banks that pays between 3 percent and 3.25 percent.

Financial Inclusion should be viewed as a right which every Nigerian should be part of! It should be seen as another American styled Universal Health Insurance for all Nigerians. Policies requiring certain items like the National Identity Cards should be relaxed, because it was not every Nigerian that got their Identity Cards when the last exercise was conducted nation wide! Besides, when the exercise was conducted in 2003, some of the adults today were not up to 18 years, and these people must use bank accounts or services.

Nevertheless, the Central Bank should discourage situations where loans are not granted to the real people in the real sector of our economy, with the real intension of creating jobs for the unemployed persons in the land, because, giving loans to those who finance their

greeds, instead of adding values to our economy and boosting the revenue base of the nation through the tax they would pay to the government is tantamount to committing economic suicide.

Written By Comrade Edwin Ekene U

[email protected]