Export Policy Brief, November 2020: Assessment Of Nigeria Export Expansion Grant, Reversed Auction Process And Non-oil Export Performance Before Afcfta Takeoff

1. Background

1. The Export Expansion Grant (EEG) scheme is one of the numerous government programmes that aim to increase the volume and competitiveness of Nigeria non-oil export through incentives granted to exporters. The scheme is synonymous to export market development grants used by various countries to boost and aid economic growth through the development and expansion of export markets. The EEG scheme was established through the miscellaneous and export incentive Act No.18 of 1986, the program had since gone through a rough and an uneasy course, due to implementation challenges, massive claim backlogs and continuing suspension and reintroduction of the scheme. Experts have argued that these irregularities had plagued the scheme, and also jeopardized the country’s quest for economic diversification, even as the full commencement date for trading on African Continental Free Trade Area (AfCFTA) agreement, is before us.

The diversification to non-oil export will be enhanced by the establishment of the AfCFTA agreement, that is enshrined with the objective of creating a single continental market for goods and services, the free movement of business persons, investments, and to boost Intra-African trade through trade liberalization [1] .

However, the EEG scheme that should promote and position the non-oil export sector for growth was suspended, interrupted and reactivated several times between 2005 and 2013 [2] . The last suspension was in August 2013 before the Federal Executive Council (FEC) reintroduced it in July 2017, and it was declared that the sum of N2.67 trillion in outstanding claims would be paid through promissory notes to non-oil exporters, under EEG scheme, contractors, manufacturers, and other creditors over a ten years tenor [3] .

Afterward, the Presidential Initiative on Continuous Audit (PICA) reviewed the outstanding EEG claims of non-oil exporters to confirm the respective amounts to be included in the Programme in April 2018. Details of the EEG claims/debts were transmitted and formally received by the Senate during its session on 9th May 2018. The backlog of unpaid EEG claims that was debated and approved by the National Assembly (NASS) in 2018 was N195.09 billion. This amount was expected to be paid to 269 non-oil exporters that were owed from 2007 to 2016. As at mid-2020, these outstanding claims are still in contention, more so, as a National Assembly document revealed that the proceedings and voting to clear the backlog, took place on the 5th December 2018 [4] .

In April 2019, the Debt Management Office (DMO) released the modalities for settling the obligations to the non-oil exporters through the issuance of Promissory Notes (PN), based on a Reverse Auction Process (RAP) [5] . It is instructive to note that the DMO engaged KPMG to perform a desk audit of the EEG claims as submitted to them from the National Assembly through the Ministry of Finance. However, non-oil exporters were not consulted to defend queries arising from their claims which meant that exporters could be penalized for administrative lapses in the processing of these Promissory Note payments. Africa International Trade and Commerce Research (AITCR) understands that approximately two dozen exporters had their claims significantly understated in the submission to the National Assembly that were transmitted to the DMO. Payment of Promissory Notes by the DMO could not exceed the approval by the National Assembly for each exporter and these claims would therefore be potentially lost to the exporters.

The Promissory Notes initiative has also been widely criticized by non-oil exporters on the account that the mode of settling the outstanding claims is an abuse of trust, discouraging, damaging to the credibility of the scheme and worse still, that the RAP arrangement was lopsided as only non-oil exporters, among the group that was approved to benefit from the issuance of Promissory Notes (PN) were subjected to the additional process of RAP [6] . AITCR findings from non-oil exporters revealed that RAP was abandoned, mid-way and an average of the discount bids was adopted by DMO to allocate PN's to all bidders, which had complicated and compromised the entire process because the procedure for arriving at the average was considered not to be transparent by any standard. Between December 2019 and February 2020 DMO had issued N145.371 billion [7] PN to beneficiaries of the EEG programme with maturity dates for the notes set between December 2019 and December 2024.

- EEG Historical Perspective

EEG scheme was established under the Export Incentives and Miscellaneous Provisions Act, No.18 of 1986 [8] . It is a post-shipment incentive intended to advance the competitiveness of Nigerian products and commodities, expand the country’s volume and value of non-oil exports as well as diversify Nigeria’s export and market coverage [9] . At the inception of the scheme, cash inducement was disbursed to exporters who met the requirements to benefit from the Expansion Fund (EF) based on the value of their semi-manufactured or manufactured products as prescribed by the Act, from time to time through the Nigerian Export Promotion Council [10] .

However, from 1999, payment of grant through Negotiable Duty Credit Certificates (NDCCs) was introduced in order to conform to World Trade Organisation (WTO) rules instead of paying cash to exporters. The NDCC as a negotiable instrument was transferable from the original beneficiary to a third party (up to a maximum of three transfers) and granted to exporters for payment of import and excise duties. Exporters that had no import duties to pay were still allowed to benefit from the NDCC instrument. It also enhanced exporters’ ability to reduce overhead costs, given the increasing cost of production for export and secure bank loans with the NDCC instrument.

By 2004/2005 EEG was redesigned to apply to the following three categories of Exporters namely, Exporters of Manufactured Products, Exporters of Semi /Non-Manufactured Products and Merchant/ Exporters of Primary Products [11] . The new guideline on EEG that was released in 2005, made NDCC an instrument for import duty payment only [12] . All outstanding claims in respect to transactions made during the suspension of the scheme and its subsequent lifting were said to be processed under the old EEG scheme rate (i.e. exports made with Bill of lading dated on or before the 31st December 2004) [13] .

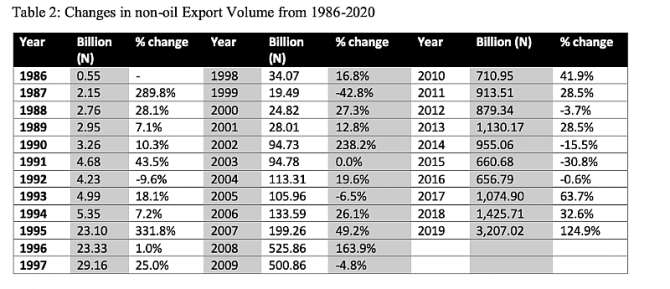

Table 1: Tracking EEG Scheme Disruptions from 2005 -2014

However, the scheme was yet again suspended in 2013 to give room for review, redesign and to ensure it is fit for purpose. In June 2017, when it was reactivated, NDCC was replaced with the Export Credit Certificate (ECC) [14] . ECC, unlike NDCC, was used to settle all federal government taxes [15] . The other difference is that NDCC was transferable between traders without restrictions on its title and tenure, while ECC is just valid for two years after it has been issued and transferrable only once within the period. The ECC’s other alternative use includes the following:

- The settlement of FGN taxes, for example, companies income tax, value-added tax etc.;

- The purchase of FGN bonds;

- The settlement of credit facilities by the Bank of Industry, Nigeria Export-Import (NEXIM) Bank and Central Bank of Nigeria (CBN) intervention facilities; and

- The payment of liabilities owed to the Asset Management Company of Nigeria (AMCON).

Unlike the first review guideline of 2005 where all outstanding claims were settled based on the previous guidelines. The reviewed EEG under the latest guidelines proposed to settle all outstanding claims of qualified exporters (accumulated during the period of suspension) using the new reviewed EEG guidelines (i.e. exports made with Bill of lading dated on or after 1st January 2014).

Analysis of the Impact of EEG on Changes to Non-Oil Export Volume

The effect of the vicious circle of sustained suspension and reintroduction of the EEG scheme coupled with settlement delays and COVID-19 outbreak has been very glaring on the Nations’ trade flow. Recent statistics reveal that the value of Nigeria’s trade-in Q1 2020 stood at N8.3 trillion. This represents a 17.94 per cent decline in trade compared to Q4 2019. According to the NBS report, the value of total exports decreased by 14.42 per cent relative to the previous quarter and 9.98 per cent when compared to Q1 2019, and total imports declined by 21.08 per cent on a quarter-on-quarter basis; however, it increased by 13.99 per cent year-on-year [16] .

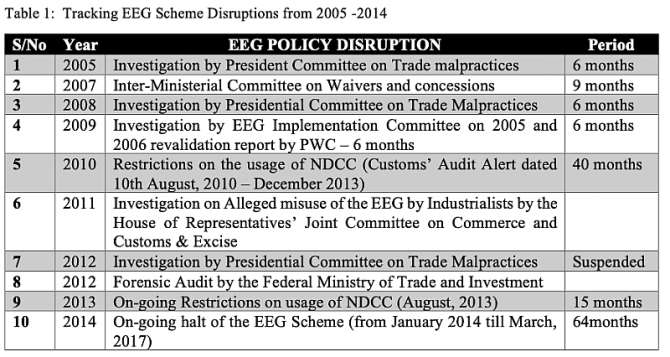

Table 2: Changes in non-oil Export Volume from 1986-2020

Source: AITCR computed using Data from CBN statistical bulletin [17]

The table tracked the changes in the non-oil export from 1986 when the scheme was first introduced to 2019. From 1986 to 1999, when exporters were issued NDCCs. The changes were considered to be all positive with the exception of 1992 negative change which signifies a decline in the non-oil export value compared to the previous year. This decline might not be unconnected to the general election and political uncertainty in the country that year. However, in 1999 when NDCC was introduced, non-oil export declined by 42.8 per cent. Nigeria experienced a moderate surge in non-oil export from 2005 to 2013 when the scheme was suspended. Over this period, the value reached its absolute peak in 2013 of N1.1 trillion. It is important to note that the suspension led to a major decline in the export volume. It is, therefore, safe to conclude that the decline would not have been recorded during this period if the scheme had been active.

The non-oil export sector consistently declined between 2014 and 2016 in absolute terms when the scheme was in suspension. These are some of the reasons why the non-oil sector is performing below expectation when compared to oil export.

Exporters Experience of EEG under the DMO Settlement structure

Information gathered from non-oil exporters who should have been beneficiaries of the EEG scheme revealed their frustration and discontentment with the arrangement of debt settlement through Promissory Notes (PN). While lauding the efforts of the federal government in reactivating the scheme, they expressed gross dissatisfaction with current PN settlement process. Exporters that participated in the survey revealed the agony of having to wait for an average of 10 years to receive their outstanding claims. Many opined that the scheme had defeated the original purpose of establishing it, which is to encourage the growth of non-oil export and support the diversification of the country’s economy away from oil.

Exporters revealed that asking them to discount their already issued PN is a rip-off especially when many of them have had the value of their outstanding benefits already eroded due to devaluation, inflation and payment of interest on loans. A key exporter who had been in the export business for over three-decades and having therefore witnessed the EEG from inception berated the government over the use of promissory notes which come with discounted bids with four years maturity period. The exporter termed the process as double discounting following an initial discounting of their benefits with the export certificate for duties settlement with Nigeria Customs Service (NCS). It was also gathered that exporters who do not want their benefits discounted have the option of waiting longer for the maturity of their instrument. One of the exporters lamented that he was not invited to partake in the bidding process after receiving only 36.6 percent of its actual outstanding claims and the banks are after him for unsettled bank loans.

Majority of the randomly selected non-oil exporters that participated in the EEG experience interview; said the government’s policy on EEG had not positioned their business for growth. They lamented that they are aware of colleagues that have closed their export business, due to government’s complicated process of paying the outstanding claims.

The National Assembly further aggravated the frustrations of the non-oil exporters' beneficiaries, by approving only 75.4 percent of Nigeria Export Promotion Council (NEPC) verified total exporters claim for Promissory Notes that was sent to them in 2018. Most of the exporters said they are being shortchanged and penalized for being non-oil exporters because they have incurred high holding costs on the government instrument they used to secure facilities from their banks. They said the government must appreciate that non-oil exporters negotiated long term contracts on the basis of this grant and in many cases lowered their prices to penetrate new markets on the strength of the expected benefits from the EEG.

- Conclusion and Recommendation

There is no doubt that the reintroduction of EEG is indicative of the desire of the government to diversify the economy and boost non-oil exports, but the current drawback in settlement of outstanding claims will not provide Nigeria with the opportunity to maximally reap the dividend of AfCFTA through access to a large market with close proximity. Industry expectations are that the Nigerian government should have gone past the settlement of backlogs of outstanding claims to granting more funds to exporters to position the country well ahead of the first AfCFTA commercial transaction slated for the 1st of January 2021 [18] .

Likewise, adopting a Promissory Note as a payment instrument with a delayed maturity date but without any attached coupon rate effectively and immediately devalued the EEG claims by a projected estimate of 40 percent. This has created a situation of export incentives obscurity and distrust for Government export policy. The National Bureau of Statistics’ (NBS) recent report reveals that Nigeria recorded a trade deficit of N138.98 billion in the first quarter (Q1) of 2020 [19] , making it a second consecutive quarter of negative balance of trade alluding to the damaging effect of outstanding EEG settlement on Nigeria non-oil export and break in the supply chain due to COVID-19 pandemic.

The current settlement model by DMO does not take into cognizance the problem of the tenor of the interest on loans incurred by non-oil exporters. Some of the debts owed to exporters are between 3 and 12 years; this outstanding debt tenor is not built into the repayment programme with the application of Promissory Notes system, which further extended the settlement tenor. This is a disincentive to non-oil export business in Nigeria because an exporter should not have to wait to get a refund to boost his/her export business for close to 10 years.

This arrangement of discounting promissory notes has a distortionary effect on trade outlook and restricting non-oil exporters’ capacity to be competitive amidst AfCFTA takeoff. The country currently stands the risk of losing sizeable non-oil export revenues and Nigeria would be placed at a disadvantaged position as AfCFTA takes off January 2021 [20] .

The government should honour their outstanding commitment to non-oil exporters in full as this would serve to reinvigorate the non-oil export sector, with a multiplier effect on job creation, increase foreign exchange revenue and avert additional losses that would lead to a further collapse of the non-oil export sector. Nigeria should critically consider adapting EEG as a pro-non-oil export policy, which will scale-up the non-oil export market development grant to shield exporters from losses arising from COVID-19, just as the Australian government has done. [21] Therefore, the government should consider the following recommendations

- To guarantee the effective implementation of the scheme, by addressing the challenges highlighted above.

- PN maturity tenor should be reviewed to ease non-oil exporters’ hopelessness, distress and misery by reverting to the settlement with the full face value of the outstanding claims.

- Given the benefit of non-oil export to export-led economies globally and the quick pace at which it translates to economic prosperity within a very short time, the government should not sacrifice full export grants for short time fiscal gains.

- The annual projection for EEG grants should be paid promptly to support non-oil exporters’ ability to make a sound projection for the year.

- With the first commercial AfCFTA contract slated to commence by 1st January 2021, the Federal Government through the National Assembly should incorporate a system that will increase the export volume of qualified non-oil exporters in Nigeria.

- The discounting of PN’s should be expunged to ease exporters’ burden, especially with those who have incurred heavy interest debt on their loans.

This Export Policy Brief was compiled by Africa International Trade and Commerce Research (AITCR)

Contact Address

Africa International Trade & Commerce Research

Abuja, Nigeria

+2349074690373; +2348147429461, +2349058603907

Email: [email protected]

Tw:@africatradelink

IG: africa international trade

FB: www.facebook.com/africainternationaltrade

www.africainternationaltrade.com