Africa: An Imminent Financial Peril??

Mr. Mervyn King, former head of the United Kingdom’s Bank of England, recently stated that another financial crisis is “certain” and could come sooner rather than later. Mr. King also believes that most politicians and Central Bankers don’t understand what caused the most recent financial crisis dating back to 2008. Accordingly, without understanding the 2008 crash how could they understand, prevent or deal with another pending crash?

The writers herein have published several articles on the internationalization of the previous and suggested pending financial situation and its potential impact on global economies; the two articles in mention were: The global economic and financial outlook for the year 2013 and its effect on the future of the world economy the second being the global financial crisis and its impact on a specific economy/s: namely inter alia Africa. Within the said papers there was an effort try to raise the urgency of financially what was looming and its consequences on an/any economy. It appears that many African countries are inactive to this potential consequence and have taken this issue way too lightly, also are preoccupied with other domestic and or international policy, Rightly or wrongly.

Regarding Africa and ignorance of the facts appearing around an economy could be the occurrence within Francophone Africa. Whereas most all domestic reaction within a jurisdiction would be in the interest of their own country, in this instance such may be flawed. Although said African countries are independent sovereign states, it could be said they are constituted as a shield for France; most these countries may offer a sacrifice financially so that France may survive, thrive and prevail. To achieve this shield the former colonial power France have predetermined and land locked the African election process. The election process is manipulated in advance by those who promoted the interests of France before the African national interests. 10% of the presidential elections in Africa Francophone are honest with the remaining 90% allegedly manipulated, influenced and corrupted by external interests. Maybe this issue should allow the public at large to understand the inactivity in certain French African countries when facing a financial crisis.

It is imperative that the leaders of these influenced countries understand that neglect and ignorance of economic development and financial control in association with the lack of due care and attention of their own citizens will only lead to economic and cultural disaster. A Governments plundering and veiling of sovereign funds that should have gone to the development of their own population constitutes severe crimes against their own population.

EG:

1. Any Funds deposited and cleared in the currency of the US dollar, belongs to the American Treasury. Accordingly, the US Treasury knows the identities of these currency owners when deposited in any bank in the world. Just as the identities of funds owners depositing cash in the currency of the Euro, Yen etc. are known to the sovereign currency owners.

2. Presidents of countries that have plundered sovereign funds and which are deposited in foreign banks can become hostages of the countries that own the funds and are potentially subject to obey the orders and or demands of such sovereign governments. An example could be the former President Mr. Mobutu Sese Seko (MSS) of Democratic Republic of Congo (DRC) whom deposited several billions in various currencies in many European and the USA banks. In 1983 the sum of the funds deposited by MSS could have paid the debts of his country for generations ahead, however he fled his country and the majority of the deposited funds were confiscated by the banks at the behest of the relative sovereign governments and today now the funds have not been returned.

The case of Ivory Coast, Former President of the Ivory coast Mr. Felix Houphouet Boigny had billions in varying currency’s deposited in European banks, American banks and etc.. at his death there was only circa 10 % of the deposited funds made available to his heirs and estate. Post several years of legal battles that afforded almost half of the 10% collected. Regarding the remaining 90% of the funds, who are the new beneficiaries? Not the Ivorian people or the Government!

The Gabon scenario: This issue could be considered worse than the Ivory Coast. Former late President Omar Bongo of Gabon was a great servant of France and “Franceafrique”, but not his country, Gabon. ” If the former Gabonese president had put lot cash and energy and enthusiasm into the development of his country of rule as he did into the development and promotion of France and “Franceafrique, the republic of Gabon would be a very advanced country with all the infrastructures and necessary technologies that would have made Gabon a state to be compared to Singapore in Asia, where citizens eat three meals daily, no unemployment and Gabon would be considered a paradise. Why is Gabon prohibited from having access to the funds deposited by the former late President of Gabon in foreign banks to assist and contribute to the development of his country? In exchange, he was humiliated by the stories of “ill-gotten gains”. Instead these funds are applied to certain African countries requests whom are looking to better their own development and further to enhance the interests of the holding countries who think to renegotiate some better agreements with African nations to suit themselves. The most important issue should be that the “ill-gotten gains” should not be used for benefit of other countries like Gulf Arab countries, Asia countries, European, American etc. etc.., these mentioned countries already receive red carpet treatment in France and other Europeans countries.

• The Nigeria case, Former Nigerian late President Sani Abacha had an estimated sum of funds deposited in Europeans banks, American banks and other global institutions amounting to 10/15 billion dollars. Since his death several successive Nigerian governments have reclaimed these funds for the need of the Development of Nigeria. Almost 20 years have passed and only a few hundred million dollars have been returned to the Government of Nigeria. Said few hundred million dollars constitute only partial interests earned on the funds deposited in these banks. Who controls the rest of the money? Why are these funds are not transferred back to Nigeria? Ultimately it's not the family or country of former late President Sanis Abacha that controls these funds deposited in European and American banks today!

After having spoken of the possible inactions of some governments of Francophone Africa we will try to focus on serious risks to those countries whom have deposited their reserves funds in Western countries. We will review the financial position of the world’s major banks and more specifically those based in France.

We'll start with the big six banks in U.S.

We think it is our duty to share this information, and the terrible potential implications of a financial collapse and the financial survival of humanity that is at risk:

The present global financial situation is more severe than the known crisis in 2007 and 2008; 6 Americans banks have total assets equivalent to 9,9 Trillion USD against a debt exposure due to derivatives and other paper products amounting to 278 trillion. We do not add American sovereign debt which is almost Nineteen Trillion Dollars (19,000,000,000,000 USD) plus the public deficit of the other government agencies which are more than one hundred trillion (100,000,000,000,000 USD)

Of the six major banks, it is noted that Wells Fargo Bank appears to be a little better held compared to other banks.

1. "Bank JP Morgan Chase"

Total Assets: $ 2.573.126.000.000 (about 2.6 trillion dollars)

The total exposure to derivatives: $ 63,600,246,000,000 (over 63 trillion dollars)

2. "Citibank"

Total Assets: $ 1.842.530.000.000 (over 1.8 trillion dollars)

The total exposure to derivatives: $ 59,951,603,000,000 (over 59 trillion dollars)

3. Goldman Sachs

Total Assets: $ 856.301 billion (less than one thousand billion)

The total exposure to derivatives: $ 57,312,558,000,000 (over 57 trillion dollars)

4. Bank of America (BOA)

Total Assets: $ 2.106.796.000.000 (a little over 2.1 trillion dollars)

The total exposure to derivatives: $ 54,224,084,000,000 (over 54 trillion dollars)

5. Morgan Stanley

Total Assets: $ 801.382 billion (less than one trillion usd)

The total exposure to derivatives: $ 38,546,879,000,000 (over 38 trillion dollars)

6. Wells Fargo

Total Assets: $ 1.687.155.000.000 (about 1.7 trillion)

The total exposure to derivatives: $ 5,302,422,000,000 (over $ 5 trillion)

According to the prestigious firm of Casey, European banking stocks are falling ..

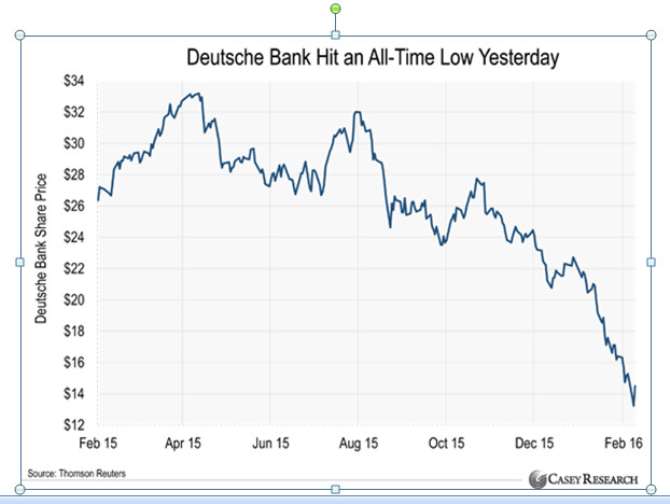

Deutsche Bank (DB), the largest bank in Germany, has plunged 36% this year. Its stock is at its lowest level.

Credit Suisse (CS), a major Swiss bank, fell 40% this year to its lowest level since 1991.

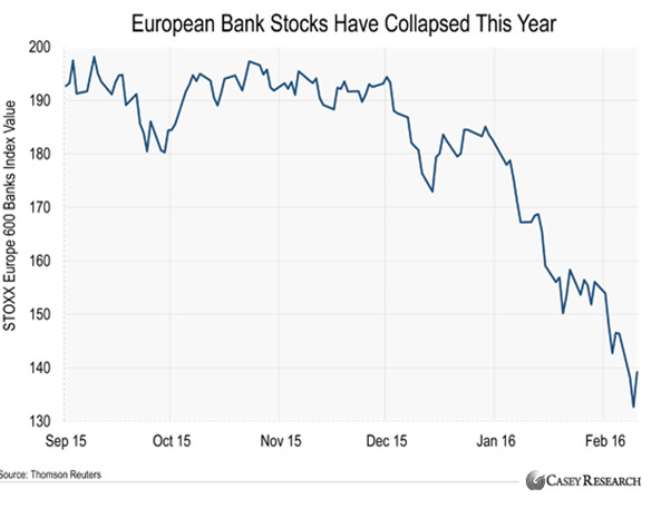

As you can see in the table below, the Eu 600 Banks Index, which tracks major European banks, is down 27% this year and continues to fall, its longest losing streak since the financial crisis of 2008.

The massive sale of the shares of European banks has created a falling for other European equities. The Europe 600 Index, which tracks the 600 largest European stocks, is down 15% this year to its lowest level since October 2013.

European banks that are struggling to make a profit:

After having made a profit of € 437 million in 2014, for the fourth quarter, Deutsche Bank lost € 2.12 billion. Credit Suisse lost € 5.83 billion in the last trimester, having made a profit of € 691 million the previous year. The profits of BNP Paribas, the largest bank of France, plunged 52% last quarter.

The inadequate monetary policies of Europe continue to deny Europeans banking income ...

Many people know that the Federal Reserve kept interest rates at zero effectively since 2008. The European Central Bank (ECB), the US version of the Fed Europe, has also cut rates after the financial crisis World. Unlike the Fed, the ECB did not stop at zero, and lowered its key rate further in June 2014. The European Central Bank was the first major central bank to introduce negative interest rates. Today, the policy rate is 0.3%, which sets the tone for all interest rates in Europe. This pushes banks to charge extremely low interest rates on loans and has reduced bank profits, as reported by the Wall Street Journal:

The very low interest rates reduce the profits of banks that make loans, Investors are inclined to believe that this practice of monetary policy is here to stay. The long-term rate at which banks lend then falls to be a little more than short term which banks borrow.

The idea of negative interest rates may appear odd to the man is the street. After all, the purpose of lending money is earning interest. With negative rates, if you deposit 100,000 Euro to -1%, you collect 99,000 Euro. The negative interest rates are a system to get people to spend more money. According to the classic economists, spending will drive the economy. By reducing its key interest rate to less than zero, the ECB knows that it is impossible for people to earn interest on their savings. This discourages savings and encourages spending.

According to Casey Research, Doug Casey founder, it is the exact opposite. Expenditure does not lead the economy. Production and savings are the strength of the economy. You need to save to accumulate capital, and capital is necessary for all.

Negative rates have not helped the European economy

During the third quarter the European economy grew by 0.3%. Europe's unemployment rate is 9%, compared to the unemployment rate in the US it is nearly double. The euro also lost 17% of its value against the US dollar since June 2014. The negative interest rate is a relatively new system created by governments. Negative interest rates didn’t exist in the past. Per the Wall Street Journal, countries that account for 23% of world production now have negative interest rates. They are dangerous, In February 2016, Japan, the world's third largest economy, has joined the list of countries with negative rates. Sweden, Denmark and Switzerland all have negative rates and opened the way for a huge economic and financial catastrophe and large losses. Owning physical gold is a suggested method of avoiding such losses or may act as a loss mitigation or could this be a controlled method of inflating the price of gold via demand? Unlike paper currency and central banks can not destroy the value of gold with bad policies. In contrast, the value of gold usually rises when governments devalue their currency.

According to the graph below the shares of Deutsche Bank have a drop of 46% over the last year and have reached a historic low level. Deutsche Bank jumped 10% after the Company stated that it wished to set up a program to repurchase its issued bonds, which raises questions on how this acquisition will be done and with what funds? What will be the consequences on the evolution of finance from the bank? Deutsche Bank is in trouble. They barely survived the last crisis, they took enormous risks to make the most profit, but its winning streak came to an end and they must still fulfill their obligations. Deutsche Bank also have problems beyond their control. Europe is not growing; it is also facing negative interest rates. This is a double hard blow for the big banks, especially those who took too many risks.

CASE OF FRANCE

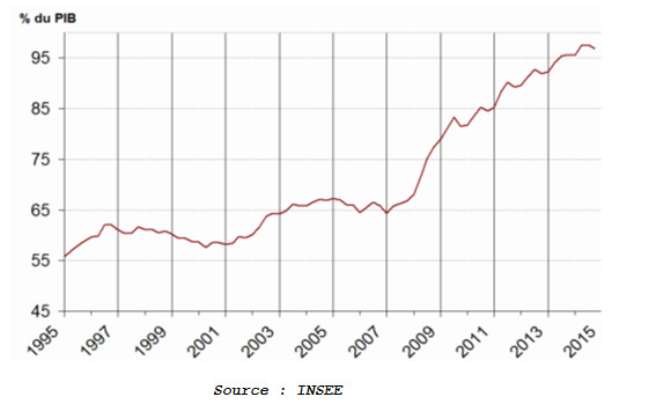

The country of France may fall into economic and social chaos as never experienced. Worse than what had happened in 1789 or 1968. The fall has already begun. In the months and years to come, this may accelerate and France will lose their rank in the concert of developed nations. If nothing is done to stop this financial bleeding, an event that began in 1974 after the election of former president Valerie Giscard Destaing, France will implode financially. France is still in the red and cannot appear to balance their accounts, a recurring issue for almost two or three generations. The French debt rose from 21.2% of GDP and is now at almost 99% of GDP. According to INSEE, the current debt of France is averaging 2.1032 trillion Euros, which represents roughly 31,000 Euros per child, woman and man. what makes it worse is that the interest is accumulating and France is unable to honor their debts going forward. The great France has become a "plane without a pilot" with an uncertain future!

Source : INSEE

The collection of taxes should allow a state to take care of education, defense, housing, infrastructure, and so on. In the 1980's France needed 1/3 of the collection of taxes to pay interest only on debts, not on the principal plus interest. Today almost half of the tax collections goes on interest only! In 2015 according to INSEE, net revenue of the state was 221.5 billion Euros and expenditure 296.1 billion Euros. Each month the France borrows circa 12 billion Euros from the market to exist and survive.

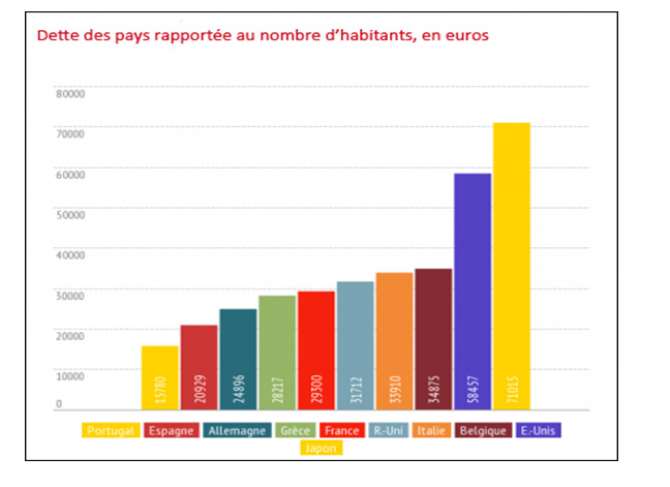

The chart below shows we can see that France is more in debt than Greece compared to population per head. What happened to Greece, they did not want to fail but it is the accumulation of debts, no growth and the inability of Government to cope with the economic and social situations that have overwhelmed them. These cultural changes require astute and tough financial policy not an “open check book/bail out/bail in approach”. Greece could be the tip of the ice berg. France is entering the red zone with all its Economic and social consequences with the so-called Francophone countries. Their capital reserves in French banks are no better than American large banks. Above illustration shows that thanks to the policies of global central banks, such as Japanese, American, European etc. francophone countries that have aligned their politics and banking policy on the system dictated by the French and international Governments, this may be a disaster waiting to happen. Not only may France fall but their banking depositors too!

According to the Point French newspaper, January 5, 2016 Mr. Marc Vignaud wrote; since 1 January, 2016 a new European law provides for how much a customer may have to sacrifice from his/her bank account in the event of bank failure. “The new puncture level with no specifics”. Accounts over 100 000 Euros are targeted specifically. The problem being don’t know the percentage that will be levied? 1%? 2%? 5%? 10%? Or more? Welcome to the world of “Bail ins”. Whom will be the beneficiary of the bail in? The Government? The Bank?

CONTRIBUTIONS:

Dr. Amouzou received His Master in Business, from the European Advanced Institute of Management, has Certificate in Finance and Investment in Paris, France. He completed His work Post Graduation in Political Strategy, International Relations and Defense Strategies and earned His PhD in International Finance.

Contribution to this article

West International Petroleum LLC; Fundacion Paraiso Sin Fronteras; Amouzou Nkrumah Production; Kokou Paul Amouzou.