A COMPARATIVE ANALYSIS OF 2012 FGN BUDGET

On Friday, April 13, 2012, the president signed the 2012 Appropriation Bill, changing it into the 2012 Appropriation Act and thereby giving us our 2012 budget. Don't ask me how come it is coming into effect in the middle of the first month of the second quarter. Space will not allow me to attempt to explain what the government has been using from January to March and to attempt to delve into the issue of Sovereign Wealth Fund (SWF), SURE-P and the famous and not-so-palatable “palliative measures” for fuel subsidy removal or reduction. Note that the budget supposedly includes N881 billion for fuel subsidy (N72 billion per month) even though N300 billion was deducted for fuel subsidy in January and February alone. This means the figure is unrealistic.

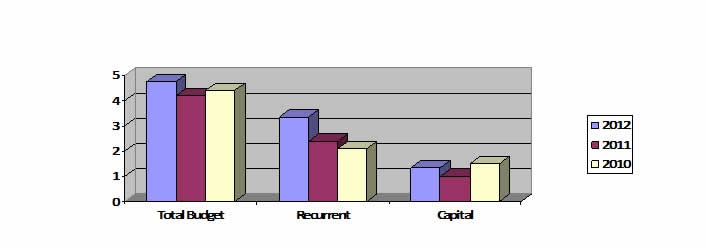

The purpose of this analysis is for the reader to get an insight into the 2012 FGN budget in comparison to 2011 & 2010 budget and also in comparison to the US budget of 2012.

2010 & 2011 FGN budgets

The 2010 budget of the Federal Republic of Nigeria for 2010 was N4,427,184,596,534 (4.4 trillion), consisting of N2,137,574,700,030 (2.1 trillion) in recurrent expenditures and .N1,563,652,282,585 (1.5 trillion) in capital expenditures. The balance was in debt servicing and statutory transfers. On the other hand, the 2011 budget is N4,226,191,559,254 (4.2 trillion), which is made up of recurrent expenditures of N2,481,705,176,915 (2.4 trillion) and N1,005,989,391,174 (1.01 trillion) in capital expenditures. Again, the remainder is for statutory transfers and Debt servicing.

The figures below are extrapolated from The Federal Republic of Nigeria 2010 Amendment Appropriation Act from the National Assembly, July 2010; The Federal Republic of Nigeria 2011 Appropriation Bill; and The Federal Republic of Nigeria 2012 Amendment Appropriation Act from the National Assembly, April 2012. So, if you are concerned that the sum of the recurrent and capital expenditure does not equal the total budget amount, it because you have other items such as debt servicing and statutory transfers, as explained

| YEAR | Total Budget | Recurrent Expenditure | Capital expenditure |

| 2012 | N4.749 Trillion | N3.357 trillion | 1.34 trillion |

| 2011 | N4.2 trillion | N2.4 trillion | N1.01 trillion |

| 2010 | N4.4 trillion | N2.1 trillion | N1.5 trillion |

Recurrent vs. Capital Expenditure

Recurrent expenditures can be simplified to mean those expenses that “recur” yearly such as salaries, while capital expenditure are those for new or ongoing projects such as building refineries and roads. According to Dr. Ngozi Okonjo-Iweala, the Minister of Finance (also coordinating Minister for the economy), on-going capital projects will receive priority in the budget implementation. It is easy to notice that the budget is very bloated in favor of recurrent expenditure. How can we have development when the recurrent expenditure eats up so much of an annual budget?

2012 FGN budget Analysis

The total budget for the 2012 fiscal year as seen by the table above is N 4.749 Trillion, a significant increase over the amount appropriated for 2011. Also, the recurrent expenditure for 2012 reflects the bloated nature of our government. In a situation where you have a Ministry, A Ministry of State, and several PAs and SAs in one ministry, you are bound to have a bloated government. Besides the Executive Arm, the cost of the Legislative branch is also astronomical. Recall the controversy that trailed the uncontroverted statement by the Governor of the CBN that the NASS ate up too much of the annual budget. If you understand that our population is about 167 million (extrapolated from Source: World Bank 2010 & National Population Commission 2011) in comparison to the US population of about 311 million (extrapolated from Source: US census 2011), you may be tempted to think that our budget is not so bad because our budget is only 4.7 trillion Naira (at exchange rate of 1US$ to 155 Naira), whereas the US budget for FY2012 is $3.796 trillion. The mistake will be comparing apples to oranges.

FY2013 budget

For the US, the FY2013 budget was due Feb 12, 2012 from the White House. For Nigeria, we do not know when the FY2013 budget will be submitted. According to statements from the Presidency, the 2013 budget may be submitted by September. If we can plan early, we will avoid a situation where the 2013 budget has not been approved by the second quarter of 2013. In fact, the distinction should be made here. The US Fiscal year 2012 runs from October 1 2011 to September 30, 2012, while FY2013 runs from October 1, 2012 to September 30, 2013. On the hand, the fiscal year for Nigeria is January 1 to December 31. Budgets should be submitted more than six months before the effective date to allow for debate and other issues that necessitated by democracy.

Usually, in civilized economy, when a budget is not passed by 11:59pm of the day before the beginning of the new fiscal year, the government shuts down, meaning that the government of Nigeria should have shut down at 12:01am on January 1, 2012 because we did not have a budget.

I wonder what would have happened. Let's think & talk about it.

Alex Osondu Akpodiete is an author, Computer Scientist, Educator, Consultant, Pastor, lawyer, Political & Social commentator. He has lectured Law, Ethics and Security & Intelligence Studies at the University level here in Nigeria and US. He was also certified to teach Computer Science and Mathematics by the State of Florida. He currently divides his time between Nigeria and USA where he runs a consulting firm and NGO. Contact him on 08138391661 or [email protected], & [email protected]. He is also on Facebook and you can follow him on Twitter.