Anambra’s New Tax Law: Concerned About Revenue Not Taxpayers' Rights

While the House of Representatives approved the second reading of a Bill in July to create a Tax Crimes Commission to be led by a national Inspector-General, focused on the oversight and management of an effective, fair, and appropriate tax system; the expansion of the tax net, and the protection of taxpayers' rights; the Anambra State Governor, Prof. Charles Chukwuma Soludo, thought the introduction of a reformatted digital tax payment system as the only method of revenue collection in the state would help because oil money was not largely filling state coffers.

The Bill clarifies that how much income is accessible to any administration decides the degree to which such an administration might have the option to give public labour and products.

Those who know better say tax is a pointer to how far a country can guarantee its development and improvement.

They say spillages occur when deceptive staff and specialized tax collectors conspire with residents to under-tax the citizens, resulting in underpayment. Spillages likewise happen as a result of tax avoidance, particularly that which is empowered and approved by the tax gatherer and all the more particularly among worldwide organizations working inside the country.

The outgone director of the Anambra State Internal Revenue Service, AIRS, David Nzekwu, had unveiled that the state government had an exceptional bill of N513.9 billion payable by no less than 2.1 million citizens. Conversely, state traders and commercial motor operators have fought this, claiming that their rights are not protected since the Soludo government outlawed the practice of traders paying revenue collectors in cash and market executives were disbanded.

Traders said they were skeptical about whom to even pay money to. It was gathered that since July 1, when the digital payment system went into effect, cash revenue collectors continued to swarm the markets, particularly in the Eke Awka market in the Awka South Local Government Area, confusing the bewildered traders whose shops in the markets are subject to taxes of up to N14,200 while hawkers are arbitrarily required to pay N200 at various times and places each day.

A trader who preferred not to have his name published said, "I was inside my store when three individuals claiming to be government revenue officers informed us that starting on Tuesday, we would be required to pay N14,200 for our stallage and other expenses."

Not relaxed by that development, the traders said they later visited the Anambra State Board of Internal Revenue on Friday to learn the actual situation, and were informed that on Tuesday they would arrive to seize all of the market's shops, and everyone would pay N2, 000 for the capture.

According to the source, "The government will then provide the account information for traders to use to deposit their fees. Unfortunately, they began the capture and collection of the N14,200 on Tuesday, a holiday.

"People were compelled to the market, where there were over 20 POS terminals set up, and those without cash were instructed to use their ATMs."

Our investigation on July 14 revealed that the tax enforced on the traders to pay is broken down into the following fees: N4,800 for stallage; N2,400 for market development; N3,000 for market traders; N2,000 for pollution and sanitation; N700 for biometric market registration; and N1,300 for market operation.

It appears that imposed taxes affect more than just traders. On July 12, commercial drivers across the state began a nonviolent protest against the new 25,000 naira per month tax, with the support of MEDWAS, the market's top electric driver charity.

"I did not issue the directive in my position," MEDWAS Chairman Mr. Michael Mbele said in response to the objection. "I was merely transmitting the information given to me directly by a team of government officials after the resumption of talks on the proposed new tariff."

Mbele continued, "As a driver, I agree that the new 25,000 naira tax is excessive and am urging the government to rethink its implementation because it could cause greater hardship for drivers."

The unhappy drivers reportedly eased when Soludo told them earlier that they would pay N4,000 for each driver per month, but the N25,000 for a driver per month was surprising.

"When Soludo came into power, he warned us to stop paying taxes or levies to anyone and also told us that a new tax rate of N4,000 every month under a new digitalized payment scheme, which we all agreed to, but we were shocked when our Chairman told us that, going forward, we will now pay N25,000 per month," claims Mr. Oye Ifeanyi.

Ifeanyi, whose real name was hidden, continued, "The majority of us use a hire purchase system to operate our vehicles. How are we going to feed our family and pay the owners?

"Please allow us to alert Soludo to our situation. If he has issued this new command through a reputable medium of information, such as the newspaper or radio, we want to know."

According to a brief from the Anambra State Internal Revenue Service (AiRS) office, which was endorsed by the head of the Taxpayer Education and Enlightenment Team, Mrs Sylvia Tochukwu-Ngige, under the new law, Keke riders would also pay N600 daily at the expense of N15,000 monthly, or N42,000 with a markdown of N3,000 for one quarter, or N81, 000 with a rebate of N9, 000 for half a year.

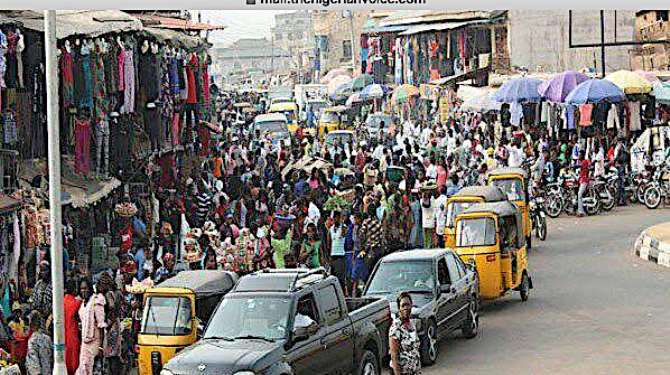

A mass protest later erupted from tricycle administrators and business cabbies in Anambra state over the tax around Awka, Onitsha, Nnewi, and Ekwulobia axis, which deadened economic activity in significant parts of the state, and the dissenters demanded that they proceed with the dissent until it is returned.

They frowned at the rate of taxation that commercial motorcycle riders (Okada riders) would pay N300 day to day at N7, 500 month to month, N21, 000 with a rebate of N1,500 for one quarter or N40, 500 with a markdown of N4, 500 for a portion of a year.

Meanwhile, Daniel Nwokoye, the newly elected President of the Management Committee of Eke Oyibo Market, Amawbia, Awka South Local Council of Anambra State, tasked Soludo in his acceptance speech shortly after polling I28 votes to beat his predecessors, Peter Nwogbo and Sunday Nnamah, who polled 38 and 22 votes respectively in the April market election, on the need to check the extortion of traders through exorbitant and multiple taxation.

Following tricycle operators' protests against what they deemed to be excessive taxes and levies imposed by the state government, the governor provided an explanation.

Professor Chukwuma Soludo asserted that the state's new tax structure would promote accountability and sanity in the system.

State government representatives gathered to explain the current policy, claiming that the Soludo administration had the best interests of the populace in mind.

Mr. Christian Aburime, the governor's press secretary, noted that the state has experienced leaks and a system of tax payments to the state government that was essentially unaccountable over time.

The Reps on the Bill sponsored by Benjamin Kalu, representing Bende federal constituency, Abia State, on the other hand, held the opinion that while taxes are the most significant method of raising public funds, countries that work to develop aim to set up a fair, just, efficient, and straightforward tax administration system that fosters citizen trust and motivates and encourages citizens to pay their taxes.

Odimegwu Onwumere writes from Rivers State via email: [email protected]