Dollar crashes to N470 at parallel market

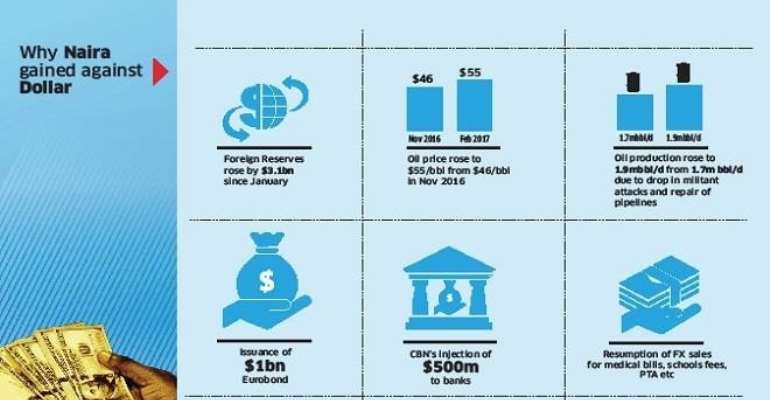

The naira has been gaining steadily against the U.S dollar in three days of trading at the parallel market.

The dollar sold for N510 on Tuesday, dropping to N505 Wednesday and fell to about N470 at the end of trading yesterday as more people trooped to the market to sell their foreign currency.

The Central Bank of Nigeria (CBN) Monday changed its rules in the supply of the foreign exchange (Forex) where it guaranteed currency supply to both small and big users.

On Tuesday about $500 million was released through the interbank market where the 23 banks bought $371m.

The naira also gained against other currencies such as the Pound sterling which traded at 645 a day earlier but slipped to 610 while the Euro came down from N537 to N507 at the end of trading yesterday.

Traders at Zone 4, Abuja, Lagos and Port Harcourt attributed the firming up of the naira to the new policy introduced by CBN.

Mr. Mohammed Salisu, a trader in zone 4 said 'buyers are sceptical while sellers are rushing to sell giving room for high speculations in the market even though the BDCs have not started receiving supply from the CBN as promised.'

Analysts have attributed the continuous appreciation of the naira against the dollar to the new foreign exchange measures announced by the CBN which has seen increased supply of the dollar to the market.

The Head, Investor Relations at United Bank for Africa (UBA) Abiola Razaq said the policy has actually shifted a lot of demand from the parallel market to the interbank market.

'We are very spot-on that the CBN policy has a direct impact on the appreciation of the naira that we have seen from about N520 back to about N500 as we speak in the parallel market,' Razaq said from Lagos.

The CBN also during the week began moves to fund commercial banks with additional Forex to carter for school fees, medicals and personal travelling allowance (PTA) and Business Travel Allowance (BTA) at a special rate.

Razaq said the PTA and BTA which formed significant proportion of demand in the parallel market, 'has reduced to the extent that CBN has been able to provide dollars to be able to meet those categories of demand at the interbank market and the banking system.'

He added that the intervention by the CBN within the week to the banks and yesterday 'wherein they (CBN) offered about $230 million', has 'created more confidence in the naira and doused speculation on the naira coupled with the fact that a lot of the demand that you would have seen at the parallel market are now back to the interbank market.'

Razaq said the appreciation of the naira against the dollar will be sustainable to the extent CBN continues to increase the supply of dollar.

Shehu Aliyu, a trader said although they have not receive anything yet from the CBN there are assurances that from next week the dollar will be released. - Daily Trust.