FIRS to implement new tax regime for Informal sector

The Federal Inland Revenue Services has begun moves to fast track the implementation of the presumptive tax regime for the informal sector.

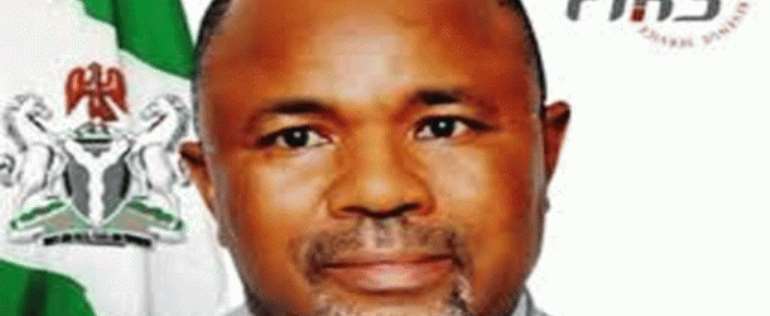

The move, according to the Acting Chairman, FIRS, Alhaji Kabir Mashi, is part of efforts aimed at improving easy access to the tax system for the large pool of eligible tax payers in the informal sector.

The FIRS boss spoke on Thursday at a stakeholders' sensitisation workshop on the presumptive tax regime held in Abuja.

He said the outcome of the deliberations would enable the Service fashion out the most appropriate way of administering the presumptive tax regime as well as harness its benefits.

The presumptive tax regulation is based on the provisions of Section 6 of the Personal Income Tax Act, 2011, which inserts sub-section 6 to Section 36 of the law.

Specifically, the new sub-section states, 'Where for all practical purposes the income of the tax payer cannot be ascertained or records are not kept in such a manner as would enable proper assessment of income; then, such a taxpayer shall be assessed on such terms and conditions as would be prescribed by the minister.

'These regulations shall apply to the informal sector, including micro businesses that have an annual turnover of N6m and below.'

Explaining some of the reasons for the new tax regime for the informal sector, Mashi said it was borne out of the Federal Government's commitment to widening the tax net.

He said, 'Taxation of the informal sector, particularly persons and businesses that are not properly structured or are unable to keep proper and detailed records of their business transactions, is a topical and challenging issue not only in Nigeria, but also in most developing countries.

'Almost every country in the world has at one time or the other been faced with the challenge of how to bring such businesses into the tax net.

'For us in FIRS, we have decided to adopt a hybrid in developing a workable presumptive tax regime. This is necessary because of our peculiar situation, where we have three taxing levels.'

He said if the country's objective of making taxation the pivot of national development must be realised, there was the need to simplify the tax system.

Mashi said, 'We have a large pool of taxpayers and potential taxpayers in the informal sector in Nigeria, which can contribute a significant amount to tax collection if they are properly assisted to comply with tax laws.

'Therefore, it is necessary for us to simplify compliance and ensure that each taxpayer feels he is being treated fairly and equally by the tax system.'