ETI gears up for competitive battle over the Nigerian market - THE CITIZEN

In 2011, the single most significant event in Ecobank Transnational's [ETI] strategic master plan to dominate the Nigerian banking market was accomplished. It acquired Oceanic Bank International, then Nigeria's fifth largest bank with peak asset base of N1.25 trillion before the financial crisis.

With the acquisition, ETI has changed its competitive positioning to become the fifth largest bank in Nigeria by asset base. With 610 retail branch network in Nigeria, ETI is now Nigeria's second largest bank by branch network, after First Bank's 650 branches.

The bank is pressing for more out of the Nigerian market. With accelerated growth rate, it seems determined to unseat the banking industry leaders one after the other and become Nigeria's largest bank in just a few years. With asset base of about N2.58 trillion at the end of 2011, it is running almost neck to neck with First Bank's N2.84 trillion for the same period.

The losses of the Nigerian Banking industry during the last financial crisis have become the gains for ETI. The turmoil, which wiped off Oceanic Bank's huge equity base of N222.8 billion, has provided a long awaited opportunity for ETI to increase its operating scale in Africa's most populous nation. The bank has positioned itself to convert the increasing consolidation in the banking sector into an opportunity to acquire market share in its target market.

In 2010, ETI changed its strategic focus to raising its operating scale considerably in key markets and Nigeria and Ghana were the main targets. In 2011, it succeeded in capturing the two markets with the acquisitions of Oceanic Bank in Nigeria and Trust Bank in Ghana - where it now holds the largest single market share.

Integration of the acquisitions was the bank's priority in 2012 when the economy of scale benefits are expected to begin to show in the operating figures. The 2012 financial year is therefore going to be the year when the reinforced presence of ETI in Nigerian banking industry will become obvious.

While the end of year figures are being awaited, interim performances are already showing the picture of what is to come. ETI has raised its growth momentum to a level that is unmatched by the leading banks in the Nigerian market. If the current growth momentum is maintained, it could become the largest revenue earner in the Nigerian banking sector in a matter of a year or two.

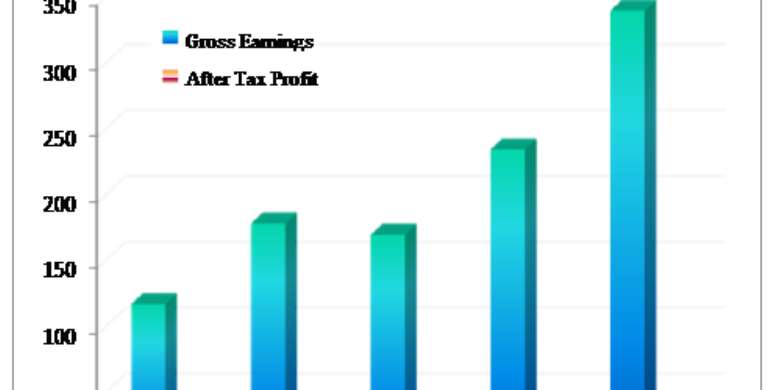

In 2011, ETI overtook UBA in terms of gross earnings and closed in on Zenith Bank. By the results at the end of the third quarter last September, it has overtaken Zenith Bank on gross income at N254.38 billion compared to Zenith's N229.16 billion. ETI has also narrowed the gap between it and First Bank on gross earnings at N267.69 billion earned by First Bank in the third quarter.

ETI's gross income at the end of the third quarter was a high growth of 63.2% over the corresponding figure of N155.90 billion in 2011. Over the same period, Nigeria's leading banks grew earnings at a comparatively lower pace. First Bank improved revenue by only 5.0%, Zenith Bank by 25.2% and UBA by 21.4%.

When it comes to the ability to convert revenues into profit however, ETI has a glaring weakness. While it is the second largest revenue earner in the banking sector, it drops to the sixth position on profit ranking by third quarter interim figures. For instance, while GTB's revenue is less than 61% of ETI's at the end of the third quarter, ETI's after tax profit is about 35% of GTB's.

The bank needs to take a critical look at its cost-to-income ratio, which stood at 69.6% at the end of 2011. A further decline in net profit margin at 9.5% in the third quarter against 12.3% in the corresponding quarter in 2011 indicates a worsening cost-to-income ratio for the bank. This is a sharp drop from the net profit margin of 15.2% recorded in the 2011 full year.

It had been expected that profit margin would improve instead in 2012 with a major gain in credit quality and a drop in provisions for impaired assets in 2011. Net interest margins have however been under pressure and a high growth of 51.2% in fee income in 2011 may not easily be repeated in 2012.

Based on the third quarter growth rate, the bank's gross income at full year is estimated at N340 billion, which will be an increase of 44.9% over the 2011 figure. After tax profit is estimated to come to N32.6 billion for 2012, which will be only a marginal improvement over the preceding year's figure.

The bank earned N1.88 kobo per its 12,837 million shares outstanding in the third quarter. This is estimated to improve to N2.54 at the end of the year. In terms of earnings per share prospects, the bank ranks slightly above 7-up and CAP. In terms of dividend pay-out however, the bank's stock is slightly below UACN property.

The bank's growth strategy of covering the waterfront seems to be responsible for its relatively thin profit margin. Higher profit margin obtained in key markets such as Nigeria gets neutralised by low margins elsewhere. This has informed management's decision to build scale in key markets. Its plan is to achieve a top three position in each market where it operates. It has attained that record in only 15 of the 35 countries where it operates.