NNPC plead with FMF for bail out

Huhuonline.com has learnt that the Nigerian National Petroleum Corporation (NNPC) has been financially insolvent since the end of December 2008, and since that time has been plunging even deeper into debt. Charged with supplying the nation with adequate

petroleum products at discounted prices and assuring the availability of petroleum products at all times including a strategic national reserve, while managing the downstream oil and gas production of the nation, the corporation has run into trouble by being forced to buy high and sell low.

In addition to losses inflicted by purchasing of crude at international prices and being forced to sell refined products domestically at regulated prices, the corporation is also forced to import some 44% of the nation's requirements for refined oil and gas products due to the underperformance of the domestic refineries.

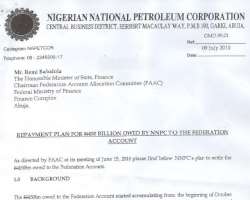

Add to this the losses of some N113 Billion in direct losses from pipeline vandalism and illegal siphoning of crude oil; it is obvious that the corporation is facing serious difficulty in meeting its mandate. The NNPC Group Managing Director, Mr. Augustine O. Oniwon in a letter, dated 9th of July 2010 and addressed to the Honourable Minister of State for Finance, Mr Remi Babalola, said, that the government regulated pricing policy is primarily to the blame for the accumulated losses of N1.2 Trillion as at the end of 2009.

In December 2009, NNPC billed the Ministry of Finance for reimbursement of N1.156 Trillion which it was yet to receive. This does not take into account a further N450 Billion owed to the Federal Government in debt reprieves from previous administrations given between 2005 and 2008. This amount has now become due and apparently the corporation is not able to pay.

Mr. Oniwon also enumerated other direct and indirect costs to the corporation from frequent refinery shutdowns due to lack of crude oil supply and spare parts. He lays the blame at the feet of the government and the public by citing the perception of both the government and the citizens of Nigeria that its citizens are entitled to discounted prices on oil and gas products by virtue of being a major world class oil producer.

Additionally the government is acutely aware of the linkage between the cost of goods and services and the price of petroleum products which can greatly affect politics in a democracy such as Nigeria and in some way also wants to compensate for the poor public transport and power supply sectors.

In an effort to preserve what is left of the corporation's cash flow, Mr. Oniwon has begged the Minister of Finance to offset the N450 Billion owed from the 2005-2008 reprieves, directly from N1.156 Trillion still owed to the corporation from the Federal budget recently allocated to keep the corporation from going under. Huhuonline will watch these developments with interest and report what it learns of this disaster in the making of such strategic importance to the nation.

The unfolding development over the indebtedness of Nigerian National Petroleum Corporation (NNPC) and the plan to settle the N450bn owed to the Federation Account is hinged on an earlier directive by FAAC at its meeting of June 15, 2010 .

The accumulated debt started in October 2003 when NNPC was directed by the Federal Government to commence the purchase of domestic crude oil at international market price, without a corresponding liberalization of prices of petroleum products. Prior to that NNPC was authorized to pay for domestic crude oil at below international market price, but was also required to sell the refined products processed from the crude oil at below international market price. Consequently, subsidies earned from buying domestic crude at discounted prices were absorbed by losses from selling refined products to the nation at subsidized prices.

It is recalled that in December 2005, NNPC recorded an unfortunate but drastic imbalance, following losses from supplying petroleum products in Nigeria and accounting for N350bn. Although the nation's oil regulating body claimed to have complained to President Goodluck Jonathan who consequently approved a reprieve from paying domestic crude cost of N249bn in 2005, N85bn in November 2008 and N116bn December 2008 NNPC's debt profile still rose to N1.156 trillion in February 2009.

Even as the installed capacity of the three moribund refineries in the country is 444,000 barrels of oil per day the refinery sector with 56% of national PMS demand has shamelessly fall below the nameplate design in capacity utilization plunging the nation into continued importation of petroleum products especially PMS .

Funny enough, the NNPC despite counting its risk of losses in the course of carrying out their responsibility of ensuring petroleum product supply and distribution, it has admitted it incapability of repayment since it claims 880bn as direct losses in landing cost of petroleum products and the regulated ex-depot price and N113bn from illegal siphoning of crude oil and petroleum products from NNPC's pipeline network, N99bn in inventory holding cost of petroleum products for maintenance .

..............................................................................

....................................................................................

...........................................................................................

...........................................