Continental Reinsurance heads for accelerated growth in earnings

Continental Reinsurance is promising to achieve one of the strongest improvements in revenue and profit this year. The reinsurance company has maintained a stable growth in revenue for the past several years and profit has grown every year since 2009. The company seems to be one of the few in the market that are still able to maintain the status of growth companies after most of the rising stars fell during the financial crisis.

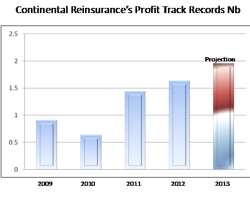

The company lifted after tax profit by more than 127% to N1.44 billion in 2011 and maintained further growth in 2012. An accelerated growth in profit can be expected from Continental Reinsurance in 2013.

At the end of the third quarter in September, the company reported an after tax profit of N1.35 billion for the group, which is an increase of 8.6% over the corresponding company figure of N1.25 billion last year. Based on the growth rate in the third quarter, after tax profit is projected at N1.95 billion for the company at full year.

The full year profit projection will amount to an accelerated growth of about 20% from the full year profit figure of N1.63 billion the company posted in 2012. It had improved after tax profit by 12.7% from N1.44 billion in 2011. The company has shown one of the most stable earnings performance records from the insurance sector in recent years. In the heat of the financial crisis in 2008, it suffered only a profit drop of 30% and recovered with a big profit leap of over 91% in 2009.

A stable and continuing growth in revenue has been maintained by the company for several years and growth is expected to accelerate as well for the company this year. At the end of the third quarter, gross premium income came to about N11.80 billion, which is a rise of 25.8% over the corresponding revenue figure in 2012.

Based on the growth rate seen in the third quarter, the company's gross premium income is projected at N16.4 billion at the end of this year. This will be an accelerated growth of 36% over the full year gross premium income of about N12 billion in 2012. Net premium income amounted to N10.39 billion during the same period and is projected at N15.2 billion at full year.

The company had improved gross premium income by 9.1% in the preceding year. Between 2006 and 2011, the company's gross premium income has doubled twice - once every two years. The trend looks sustainable for the third time in 2014.

Profit isn't growing as rapidly as revenue for the company this year and this is due to both some cost increases and some revenue shortfalls, which have caused a decline in profit margin. Two major cost elements encroached upon revenue during the period and therefore constricted profit margin.

The rising costs include net insurance benefits and claims, which at N4.97 billion, grew slightly ahead of net insurance premium at 27.2% compared with 25.8% during the period. The second is underwriting cost, which also grew ahead of revenue at 26.8% during the review period to N4.09 billion. The two cost elements depressed underwriting profit, which grew at a slower pace of 20.3% than the 25.8% expansion in net premium income.

Some revenue disappointments during the period came from other income, which dropped by 21.6% and net interest income, which went down by 8.6%. Nevertheless, the company earned N680 million in net interest income in the third quarter from placements of more than N5.0 billion with financial institutions.

Profit performance was supported by a decline of 12.9% in provisioning for investment losses as well as some cost saving in administrative expenses. The company carries investment portfolios of N4.75 billion of investments held to maturity and N2.15 billion of available for sale investments. The total investment portfolio of N6.89 billion at the end of the third quarter has expanded from N6.27 billion at the end of last year.

In all, the cost revenue balance tilted to the disadvantage of profit in the third quarter and profit margin declined during the review period. Net profit margin went down from 13.3% in the third quarter of last year to 11.5% at the end of September. Net profit margin amounted to 13.5% at the end of 2012.

The company earned 13 kobo per share at the end of the third quarter, stepping up from 12 kobo in the corresponding period last year. Earnings per share is projected at 18 kobo for Continental Reinsurance at the end of 2013. This will be an increase from 15 kobo per share the company earned in 2012. Earnings per share has been improving from 6 kobo in 2010 to 14 kobo in 2011.

The company has maintained a track record of regular dividend payment since 2007. It paid a dividend of 5 kobo per share for its 2012 operations against its peak dividend per share of 8 kobo in 2011. With earnings per share expected to make a new high this year, the company may also raise dividend per share to a new high of 10 kobo at the end of this year.