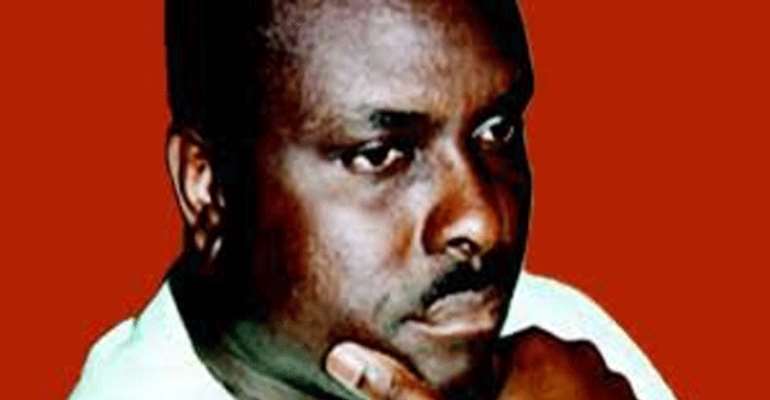

Ibori hid assets in Oando, says British prosecutor

A British prosecutor told a London Southwark Crown Court on Monday that convicted former Delta State Governor, Chief James Ibori, hid some of his assets in an indigenous integrated oil company, Oando Plc.

The prosecutor, Sasha Wass, according to Reuters, also told the court that some amount of money passed through Ibori’s Swiss accounts to Oando’s accounts.

Ibori, who governed Delta State from 1999 to 2007, was jailed for 13 years in Britain after pleading guilty in February 2012 to 10 counts of fraud and money-laundering worth 50 million pounds ($79 million).

The prosecutor Sasha Wass was quoted by Reuters in a report as telling the court that she would be presenting evidence that Ibori had 'asserted ownership of a large part' of Oando, Nigeria's biggest home-grown oil firm, which is listed in Lagos, Johannesburg and Toronto.

She added that money passed from Oando's accounts into Ibori's Swiss accounts.

A three-week confiscation hearing began at London’s Southwark Crown Court Monday during which prosecutors would present evidence of Ibori’s assets and seek court orders to have them seized.

Defence lawyers will dispute the prosecution case.

The matter, it was gathered, was raised briefly as part of an initial discussion of various aspects of the confiscation hearing.

Details are expected to be disclosed later in the proceedings. Oando is not a party to the case, although British lawyer Andrew Baillie, was in court representing the firm’s interests.

“It is unfortunate that our client has been dragged into these proceedings. There is no suggestion from the prosecution of any wrongdoing or involvement in wrongdoing on the part of Oando,” Baillie was quoted to have said outside the courtroom.

Wass said the former Chairman of the Economic and Financial Crimes Commission (EFCC), Mallam Nuhu Ribadu, would testify later in the hearing. He alleged that in 2007, Ibori tried to stop EFCC investigations into his affairs by offering Ribadu a bribe of $15 million in cash.

Ibori, who is at Long Lartin maximum security prison in central England, could be released as early as 2016 because he spent two years in custody before his sentencing and because he would be eligible for parole halfway through his prison term, the report added.

He was not in court on Monday and his lawyer Ivan Krolick, said the former governor did not wish to attend the confiscation hearing although he would come to court to give evidence if necessary.

Ibori had in February 2012 pleaded guilty to 10 counts of fraud and money-laundering worth £50m.

Oando is Nigeria's biggest home-grown oil firm, which is listed in Lagos, Johannesburg and Toronto, which has Wale Tinubu as the visible chief promoter.

One of the biggest embezzlement cases seen in Britain, the successful prosecution of Ibori was also a rare example of a senior Nigerian politician being held to account for the corruption that blights Africa's most populous country.

At the time of Ibori's sentencing in April 2012, Judge Anthony Pitts said the £50m that he had admitted to stealing might be a 'ludicrously low' fraction of his total booty, which could be more than £200m.

The confiscation hearing will shed further light on the scale of Ibori's wealth and determine whether he emerges from jail impoverished or still in possession of a large enough fortune to regain a position of influence in Nigeria.

Ibori could be released as early as 2016 because he spent two years in custody before his sentencing and because he will be eligible for parole halfway through his prison term.

In May, the Court of Appeal had rejected Ibori's appeal against the length of his sentence.

During his sentencing hearing, the court heard that Ibori had acquired six foreign properties worth £6.9m, a fleet of luxury cars including a Bentley and a Maybach 62, and that he had tried to buy a $20m private jet. His three daughters were attending a private school in rural England.

Oando in a swift reaction described the allegation as incorrect and misleading, insisting that the former governor does not own a large part of the company.

In a statement Monday night, Oando said it is a publicly traded company listed on the Nigerian and Johannesburg Stock Exchanges and does not and cannot control the trading in its securities on the floor of the respective exchanges.

'Based on our current shareholding register, Ibori's shareholding stands at 443 shares out of a total issued and paid up share capital of 6.8 billion ordinary shares, which is clearly insignificant, and cannot be considered as 'a large part of Oando', the company said.

Oando also stated that it does accept that sometime in 2004, in the normal course of its business, it sold some of its foreign exchange earnings for naira and the recipient of the US dollars was a company, which has now turned out to be one controlled by James Ibori.

The company explained that at the time of the transaction, this information was unknown to it. 'The total amount was US$2.7 million made in three separate transactions over a period of about seven months. This amount was insignificant considering the company's turnover of approximately US$800million in 2004.

'The above constitutes the only transactions between Oando and any company controlled by Ibori. Consequently, Oando cannot be described as a company where James Ibori has hidden assets as a result of these foreign exchange transactions.”