Türkiye’s Growing Drone Exports

Low-cost and high-performing, Turkish-made armed drones are capturing an increasing share of the global market. This success comes with risks, including escalation of conflict and reputational damage, but there are several ways for Ankara to manage them.

As drones change the face of modern warfare, their price sinks and their technological sophistication races ahead, more and more buyers are knocking on Türkiye’s door. Its flagship Bayraktar TB2 drone has proven effective on battlefields in Ukraine, Libya, Nagorno-Karabakh and elsewhere; it generally costs less or performs better than rival models. Ankara, surprised at and proud of this success, sees drone sales as increasingly important for the growth of the Turkish defence industry. They may also be a tool for expanding Turkish influence abroad. But drone sales are fundamentally a lethal and risky business. Lucrative defence contracts may generate revenues, solidify alliances and – in some cases – tip the power balance in conflicts, but they can also create escalation risks and humanitarian costs, along with reputational damage. With ever more drones taking to the skies, it is incumbent on leading exporters like Türkiye to enhance existing and develop new practices that can help mitigate the negative implications that exports can have for global peace and security and reduce the dangers to civilians. This approach, over the long run, may also better align their exports with their own foreign policy goals.

Changing the Face of Warfare

Drones, also known as uncrewed or unmanned combat aerial vehicles or UCAVs, have been around for decades. They are aircraft that can be remotely operated by pilots on the ground, either nearby or a continent away, or can be programmed to be autonomous. First used for surveillance, they made headlines when the United States began using them to fire missiles at targets in Afghanistan and elsewhere, often in connection with the so-called global war on terror, in the early 2000s.

Since then, the technology has forged ahead and costs have dropped, making drones an attractive tool for countries that want to project airpower but are resource-constrained. New manufacturers like Türkiye, a NATO member, as well as China and Iran, have entered a market once dominated by the U.S., Israel and Russia. Ukraine is now ramping up domestic production for its war with Russia – while also using crowdsourcing to purchase drones from other countries. The variety of drones on the market caters to a wide range of functions – surveillance, intelligence gathering, border security and the use of force – and allows actors to engage in combat in remote locations without placing operators at immediate risk. Although proponents argue that the technology allows actors to engage in more surgical combat than, for example, ground incursions, the record is littered with strikes gone awry.

Like artificial intelligence, drone technology is developing by leaps and bounds, outpacing faltering attempts to regulate it. Drones can fire missiles, bombs and guided rockets. Smaller ones can be used as weapons themselves, programmed to explode upon striking a target in a one-off “suicide” or “kamikaze” mission. Once closely associated with U.S. counter-terrorism efforts, the use of drones is proliferating, bringing with it novel practical and ethical dilemmas, including over potential autonomous drone missions (ie, ones in which there is no human involvement in decisions about whether to attack).

Competitive Edge

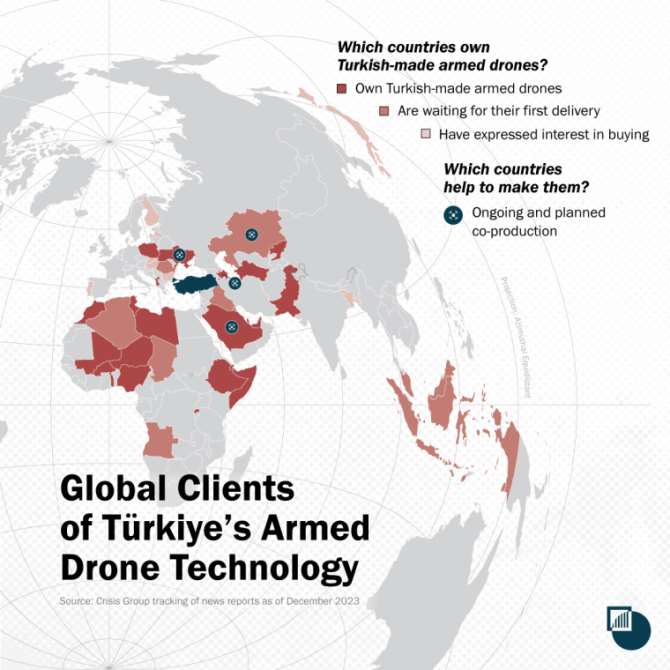

Türkiye’s young, mainly private-sector drone industry has developed with great speed and commercial success. By December, according to Crisis Group’s open-source tracking, at least 23 states had Turkish drones in their arsenals, nine were awaiting delivery and eight more had expressed interest in making a purchase. Selçuk Bayraktar, the CEO of Baykar Technologies, the largest manufacturer, said in early December that it had exported armed drones to a total of 33 countries. Most in demand is the Bayraktar TB2 model produced by Baykar. The company is run by two brothers, one of whom is a son-in-law of Turkish President Recep Tayyip Erdoğan.

Overall, Türkiye’s defence export revenues have been gradually increasing, seemingly driven in part by the sale of drones and related materiel. According to the Stockholm International Peace Research Institute, in 2022, while the revenues of Western arms manufacturers on average shrank, major Turkish defence companies’ revenues went up by 22 per cent compared to the previous year. A Turkish defence analyst told Crisis Group that he estimated that drones and related ammunitions made up about one fourth of those revenues. At a time when the general economy was ailing, drone exports have helped the defence industry keep growing.

Demand [for drones] has mounted in large part because Turkish drones are often cheaper than competitors’ products.

Demand has mounted in large part because Turkish drones are often cheaper than competitors’ products and because they have proven their value on various battlefields. After Russia invaded Ukraine in early 2022, international experts credited the TB2s with effectively bolstering Ukrainian defences. Videos circulated on social media showed the drones hitting Russian tanks and military installations. “No fancy PR campaign could have had that impact”, a Turkish defence industry representative told Crisis Group.

Earlier, the TB2 garnered international attention in three conflicts in 2020. Türkiye used them to strike Moscow-backed Assad regime forces in north-western Syria, defying the Russian air defences offering cover for Damascus and showing “to many of today’s buyers that TB2 drones can be effective even when Russia has air superiority”, a Turkish defence analyst said in an interview. In Libya, Türkiye supplied drones to the UN-recognised government, which used them in 2020 to defend the capital Tripoli from Field Marshal Khalifa Haftar, a warlord who controls the east of the country. When Azerbaijan and Armenia battled for control of Nagorno-Karabakh and surrounding regions in 2020, drones and other materiel that Ankara supplied helped Azerbaijan recapture much of the territory it had lost to Armenian control in the 1990s. TB2s were in operation again when Azerbaijan retook full control of the enclave in September.

The TB2 falls into the mid-range category of armed drones known as Medium-Altitude Long-Endurance, or MALE (High-Altitude Long-Endurance drones go by the acronym HALE). TB2s cost around $5 million, compared to an estimated $20 million per unit for the leading U.S.-made armed drone model, the MQ-9 Reaper. Buyers can thus better afford to use them on riskier operations where they might be shot down. Iran and China sell even cheaper drones, but international defence analysts say they are of poorer quality – less precise and less able to fly long missions at high altitude. “This price/performance ratio gives Türkiye an edge in the market”, a Turkish analyst told Crisis Group. Customers for Turkish drones include Ankara’s NATO allies in Europe, Arab countries in the Gulf and North Africa, sub-Saharan African countries, and others, as the map below shows:

In conversations with Crisis Group, a number of Turkish industry representatives and defence analysts said a further reason for booming sales may be that Turkish exporters are more open than competitors about sharing know-how, such as about drones’ operating systems, so that buyers (once trained) can use the drones on their own. Turkish exporters may also be more willing to share experiences of battlefield use. Others say Turkish manufacturers provide better training than rivals, with company personnel deployed to importing countries for a year or more. Turkish industry gains from these close ties. New customers’ battlefield experiences help firms make drones more resilient and effective. “There can be unexpected conditions, like differences in air temperature, humidity [or] topography”, one representative explained to Crisis Group. “The feedback companies gather each time the technology is used in a new setting is critical, feeding into research and development”.

TB2s, first used by the Turkish military in 2014, had flown over 750,000 hours by the end of 2023, generating vast amounts of data. Turkish companies also export other high-end armed drones like the Akıncı and Aksungur models, which – compared to the TB2 – can fly higher, longer and carry a bigger payload of ammunition. Türkiye aims to expand its share in this budding industry with new systems, like the more advanced Bayraktar TB3 drone and other uncrewed delivery systems, such as Kızılelma fighter aircraft and bomb-laden boats that can launch “suicide” missions against targets at sea.

How Did Türkiye Get Here?

Drone exports are a source not just of export revenue but of national pride. Most of the Turkish officials Crisis Group talked to in researching this topic between September 2022 and September 2023 say the public and even opposition parties strongly approve of the industry. The use of drones against the Kurdistan Workers’ Party (PKK), which has fought against the Turkish state since 1984 and is designated a terrorist organisation by Türkiye, the U.S. and the EU, appears to have helped generate this support.

Drones have been part of Türkiye’s arsenal for decades, though at first it relied on surveillance rather than combat drones, and purchased these from abroad. Starting in 1993, Ankara relied on nearly two dozen U.S.-made GNAT 750 drones to gather battlefield intelligence about the PKK. But it soon began building its own: Baykar, for example, began developing drone systems in 2000. In the years that followed, Türkiye continued to purchase foreign drones and other equipment, including ten Israeli Heron surveillance drones in 2010, even as its own production increased.

Ankara began actively encouraging the drone industry two decades ago.

Ankara began actively encouraging the drone industry two decades ago. In 2004, the Turkish Presidency of Defence Industries, the state procurement agency, offered large tenders to the private sector for the first time in an effort to boost domestic production. The impetus appeared to be a combination of domestic threat perceptions, namely relating to the PKK, and foreign sanctions. The U.S. and European countries had placed stringent limits on arms exports to Türkiye after its military intervened in northern Cyprus in 1974. More sanctions followed, albeit generally on a smaller scale. Following Türkiye’s 2019 military operation against the Syrian Democratic Forces (which Ankara views as the PKK’s Syrian extension) in north-eastern Syria, NATO allies imposed new arms export restrictions on Ankara. In 2020, the U.S. both slapped sanctions under the Countering America’s Adversaries Through Sanctions Act on Türkiye’s defence procurement agency, and banished it from its F-35 fighter jet program, over its 2017 purchase of the S-400 missile defence system from Russia. That same year, Canada banned the use of its electro-optical and targeting sensor systems on the TB2 due to Türkiye’s provision of these drones to Azerbaijan during the Nagorno-Karabakh conflict.

Each new round of sanctions appears to have invigorated domestic production. “We will continue to increase our investments in the defence industry until we completely free our country from foreign dependence”, Erdoğan vowed in mid-2021.

The companies that first benefited from the 2004 investments are among the top drone producers today. By late 2023, Baykar employed more than 3,600 people and had become the top defence and aerospace exporter. With its bolstered capacity, as of September 2022, it could produce over 200 TB2s per year. At the close of 2023, Baykar said it had churned out over 500 TB2s. Among other leading manufacturers, TAI-TUSAŞ and Lentatek also produce advanced MALE-type armed drones, while STM and Asisguard produce smaller “tactical” drones. STM produces “suicide” drones designed to crash into a target and explode. Turkish firms also produce components for their counterparts: ASELSAN, a leading Turkish defence contractor, for example, has been helping equip TB2s with optical systems.

Pay and working conditions at drone manufacturing firms are good. An industry representative told Crisis Group that defence companies were recruiting “the best and brightest of this country” from universities. Türkiye’s “drone ecosystem”, in the words of the same representative, also consists of some 2,000 small- and medium-sized firms spread across the country making parts from screws to lasers. Some are independently successful enough to run their own export operations. In many of its contracts, according to the same industry representative, the state procurement agency stipulates that its drone producers pass on 60 to 80 per cent of the contract value to domestic subcontractors.

Gaining Clients, Expanding Influence

Countries around the world have long believed that arms sales will help them make and keep foreign alliances. Türkiye may well be thinking along similar lines, as Ankara increasingly flexes its muscles and looks to deepen its sway abroad. Many officials have told Crisis Group that the Turkish government has sought in recent years to reposition the country as an influential mid-sized power in what they see as an increasingly multipolar world. This aim can be served by diplomacy, humanitarian aid, business, trade and security-sector cooperation – including sales of military equipment, such as drones.

Since 2021, drone exports have tended to go hand in hand with Türkiye’s efforts to mend ties and bolster trade with former adversaries including the United Arab Emirates (UAE) and Saudi Arabia. In mid-2023, Ankara signed a massive arms export deal with Saudi Arabia, including the sale of TB2s and Akıncıs. Previously, Riyadh had purchased and co-produced Karayel-SU drones. A number of these, reportedly, were shot down in Yemen’s civil war between factions aligned with Yemen’s internationally recognised government and the Iranian-backed Houthi rebels. The new Saudi-Turkish deal also includes a co-production arrangement with Baykar, though the details remain undisclosed. Türkiye and the UAE cemented an upward turn in their previously adversarial relations with a major Baykar drone deal in 2022. The UAE reportedly plans to buy 120 TB2s, one of the biggest one-off purchases of Turkish drones. Both Riyadh and Abu Dhabi seem to see Turkish drones as upgrades for less effective Chinese models or a way to scrap plans to buy costlier U.S. drones, which can also come with political requirements. If these purchases also improve their ties with Ankara, that may be considered an additional benefit.

In Africa ... Türkiye’s drone exports appear to align with its diplomatic, trade and security initiatives in what some Turkish defence analysts refer to as “drone diplomacy”.

In Africa, too, Türkiye’s drone exports appear to align with its diplomatic, trade and security initiatives in what some Turkish defence analysts refer to as “drone diplomacy”. Ankara has been beefing up its presence on the continent over the past decade with new diplomatic missions, direct Turkish Airlines flights, and defence and trade ties. African governments (mainly in the north but also in the west and other regions) frequently buy Turkish drones for use against jihadists and other insurgents, often in remote locations. In North Africa, Türkiye has supplied drones to Algeria, Morocco and Tunisia. Morocco added TB2s to its arsenal of Chinese and Israeli drones in 2021, mainly in support of its fight with the Polisario Front, an insurgency seeking independence for Western Sahara. Rabat reportedly also plans to buy Akıncıs. In response, neighbouring Algeria, whose relations with Morocco are frosty, placed new orders to augment its diverse inventory of drones, including ANKA-S, Aksungur and more Chinese drones. Tunisia bought ANKA-S drones in 2021.

Drone sales have brought new customers but also often built on existing arms ties. In 2018, for instance, Nigeria and Türkiye signed a military training agreement. In 2021, when Erdoğan visited the Nigerian capital Abuja, the two countries announced further weapons and other trade deals. In September 2022, Nigeria bought Songar tactical drones from Türkiye’s Asisguard, mainly to use against Boko Haram jihadists in the country’s north east. In October, Türkiye said Abuja had purchased an undisclosed number of TB2s and Turkish helicopters. The following March, Nigeria and Türkiye discussed building an ANKA-S co-production facility in the country. The use of drones by the Nigerian government made international headlines in early December when a strike in the country’s north west “mistakenly” killed at least 85 civilians gathered for a religious service, based on a tip that they had gathered to prepare for a terrorist attack. There were reports that the drone in question was of Turkish origin, but these have not been verified.

Researchers have long asked whether arms exports truly generate new influence for a country or just reflect its existing clout. Either way, Türkiye gains financially, and not just from the initial sale. After all, once a country buys drones or other military hardware, it relies on the supplier for ammunition, spare parts and maintenance, creating lasting dependencies that may become a valuable bargaining chip for the exporter. For example, only Turkish companies make the guided micro-rockets compatible with some Turkish drones, and customers must also turn to Türkiye to maintain optic systems or for the frequent upgrades to the artificial intelligence-supported software that makes weapons more precise. Because training takes time, it is easier for importers to keep buying new models, with similar operating systems, from the same provider. Such exports can give suppliers a certain amount of leverage over their clients.

Complicating Foreign Relations?

Whatever their foreign policy benefits for Ankara, drone sales may complicate Türkiye’s relationships with conflict parties that find themselves on the other end of this exported firepower. That said, for the most part, Türkiye has been adept at managing these challenges.

Russia is a case in point. Ankara’s cordial relationship with Moscow has long survived the two states being on, or arming, opposing sides in several conflicts. With regard to drones, Ankara has been a crucial supplier to Ukraine, where Russia has been at war since 2014, when it seized Crimea and sent troops to back separatists in the country’s east. After Türkiye first delivered TB2s to Ukraine in 2019, and the Ukrainian army used them against Moscow’s proxy forces, Russian President Vladimir Putin raised concerns about Türkiye’s drone supplies to Ukraine. Ankara deflected the criticism, suggesting that it was not responsible for how the drones were used. While this answer of course was not responsive to Moscow’s point, nothing else has come of the spat, even though Turkish supplies to Ukraine continued to grow. In February 2022, on the eve of Russia’s full-scale invasion of its neighbour, President Erdoğan visited Ukraine, and President Volodymyr Zelenskyy announced a co-production deal for TB2s with Baykar. Implementation of the deal remains in the works.

The war in Ukraine has boosted Türkiye’s drone business in the Eurasian neighbourhood.

More broadly, the war in Ukraine has boosted Türkiye’s drone business in the Eurasian neighbourhood. Moscow’s aggression has spooked Russia’s neighbours in Eastern Europe and Central Asia, which have placed fresh orders as they bolster their defences. As for why Moscow does not press Ankara harder to stop sending arms into its near abroad, it clearly sees this priority as lower than maintaining good relations with a strategically located neighbour with which it has long maintained pragmatic ties.

Complicated political dynamics are at play elsewhere as well. Serbia cancelled plans to buy Turkish drones and expressed “serious concerns about … certain NATO member states … supporting illegal militarisation” after Kosovo (Serbia’s former province, whose independence it does not recognise) said in mid-2023 it had bought TB2s. After a short period of acrimony, relations between Belgrade and Ankara showed signs of improvement after Serbian President Aleksandar Vucic and Erdoğan met in August. Drone exports have also been an issue in Ankara’s efforts to normalise relations with Cairo, which had soured in the aftermath of President Abdelfattah al-Sisi’s ouster of the Muslim Brotherhood government. Egypt has voiced its dissatisfaction with Turkish drone sales to Ethiopia, where Cairo and Addis Ababa have been at loggerheads over the construction of a giant dam on the Blue Nile.

Political and Humanitarian Risks

The growth of Turkish drone exports contributes to a broader global trend in the use of remote warfare that has implications for international peace and security. Evidence suggests that drone use may promote escalation and instability. It makes air wars cheaper and lowers the risk of troop loss. These benefits in turn decrease the domestic political costs of military action, potentially letting actors contemplate ventures they might not consider undertaking if they did not have UCAVs. Critics argue that in this way drones have substantially de-risked air war for the states that use them, but not for the civilians who get caught in the crossfire. A case in point is the so-called U.S. war on terror, where drones have sometimes been the weapon of choice, creating humanitarian costs for those on the receiving end of errant strikes, and corresponding political and reputational costs for the U.S.

Some Turkish officials and industry representatives acknowledge that as more states acquire and use drones both from Türkiye and its competitors, it may face reputational costs and unwanted security consequences. But some Turkish officials also argued to Crisis Group that the technology could, in the short run at least, reduce escalation risks by giving weaker states a way to counter and deter adversaries, thus “balancing” conflicts. In any case, negative considerations are not enough at present to undercut Ankara’s business and policy motives for expanding sales.

Humanitarian considerations are another issue. With any arms sale, there is a risk that buyers will use exported weapons in violation of international laws and norms, for instance by targeting or employing insufficient safeguards to protect civilians. Risks increase with buyers who have a history of poor adherence to international human rights and humanitarian law. Some may fail to fully consider, or may discount, the dangers to civilians of using drones in counter-terrorism operations, including urban ones, or in policing operations.

Türkiye has already got a taste of how this can play out. In 2022, international media reported that Ethiopian federal forces used Turkish drones against civilians in the brutal war with Tigrayan rebels. Both Addis Ababa and Ankara denied the story. Nonetheless, in the face of criticism from the U.S., Türkiye briefly suspended exports to Ethiopia, according to a Turkish official Crisis Group spoke to in early 2023. Besides Ethiopia, Türkiye has sold its drones to other countries – such as Mali and Burkina Faso – that Western countries have generally been reluctant to supply with drones and other lethal equipment because of end-use concerns. The Nigerian strike mentioned above is another vivid reminder of the humanitarian risks around drone proliferation.

Treading a Fine Line

As noted above, the growth of remote warfare lowers certain barriers to waging war and may therefore make conflict more prolific, as the elastic frontiers of the U.S. global war on terror appear to illustrate. Türkiye’s entry onto this stage with low-cost, high-performance products to some extent exacerbates the proliferation of this technology and the risks it creates. Still, one can imagine that from Ankara’s perspective, it is hardly the only state entering this trade, and it has every right to claim its share of the business; it might also note that if it fails to occupy this space than NATO competitors and adversaries like Russia, China and Iran will do so. Under the circumstances, the most realistic request for Ankara is that it be a responsible exporter, acting consistently with emerging norms surrounding drone exports and use, and being especially focused on the risk that exports can feed escalatory cycles that could both harm international peace and security and, more parochially, its own foreign policy interests.

Türkiye can help mitigate some of the risks of its growing drone exports by being more attentive to oversight mechanisms and end-use requirements on importers who buy its drones. Some Western defence experts Crisis Group talked to assessed that Ankara has a “no-questions-asked policy” and will sell armed drones with almost no conditions. Ankara counters by averring that its sales are carefully reviewed by the defence ministry in consultation with the foreign ministry and defence industry agency It says it bans exports to countries it assesses would use drones in violation of international humanitarian or human rights law. It also notes that sales agreements contain end-use restrictions that prohibit, among other things, targeting civilians. “[Our export] policy, practices and procedures … are regulated in strict compliance with internationally accepted norms and standards”, one official said.

International norms and standards as they relate to drones are still inchoate and flexible.

Whatever the case may be, there are limits to how much reassurance can be gleaned from these practices. For one thing, international norms and standards as they relate to drones are still inchoate and flexible. Türkiye participates in two of the most important quasi-regulatory frameworks – the Wassenaar Arrangement and Missile Technology Control Regime (MTCR) – but those have few teeth. They are non-binding and struggle to keep pace with evolving technology. Wassenaar leaves licensing criteria up to individual states, and as for the MTCR, Ankara’s armed drone exports fall below its thresholds, at least as now interpreted by the U.S. While Ankara has signed the Arms Trade Treaty (ATT), which is legally binding and requires exporters to put in place transparent national control systems and risk mitigation measures for conventional weapons exports, its parliament has yet to ratify the instrument. (Türkiye and the U.S. are the only NATO members that are not ATT states parties.) Finally, as some Turkish officials acknowledge, and other arms exporters also know, the use of arms becomes difficult if not impossible to fully control once custody passes to the buyer. While states can of course monitor end use and cancel future sales in the event of breach, in practice there are often powerful institutional, commercial and political interests that prevent these things from happening.

So, what can be done? As a formal matter, an important step that Ankara can take would be to ratify the ATT and enforce it stringently. Beyond that, Ankara should work with NATO partners to develop best practices both to minimise the prospect that drones are used to escalate conflict risk, as well as to help protect civilians who will live and work in their shadow. There is no way to sugar-coat drones’ lethality or the regrettably expansive impact they have already had on contemporary warfare. But if it can help strengthen oversight measures on this corner of the arms trade in a rigorous and responsible way, Ankara may be able to help manage the reputational, humanitarian and geostrategic risks that the rise of this still new tool of warfare may pose for itself and others.