Value Of Distributor Management System To Nigerian FMCG Companies

....The Challenge Of Getting Accurate Consumer Purchase Information In Nigeria

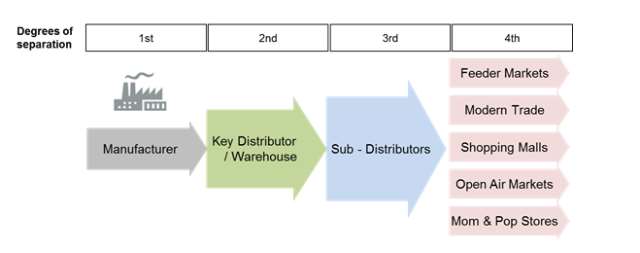

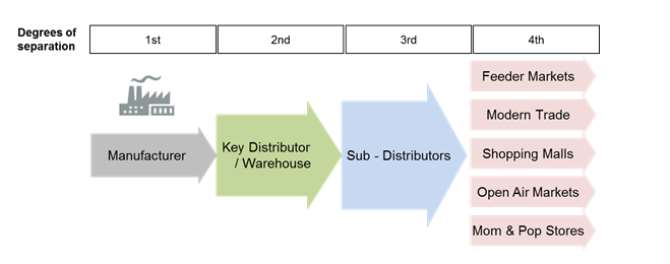

Most Nigerian FMCG companies still do not have visibility of their distribution chain. For a product manufactured for instance in Agbara, Lagos State to get to the end consumer located say in Sokoto State, the product typically has to go through an elongated, shrouded chain of distributors, sub distributors, wholesalers, sub-wholesalers and retailers.

As the product makes its way through this opaque network, the manufacturer loses visibility and control of the product’s placement. At best, most manufacturers can monitor the movements of their products only up to the sub distributor stage.

The questions that readily come to mind are: why must Nigerian FMCG companies operate under this distribution model where they lack visibility of product movement and access to information? How can this situation be remedied or improved?

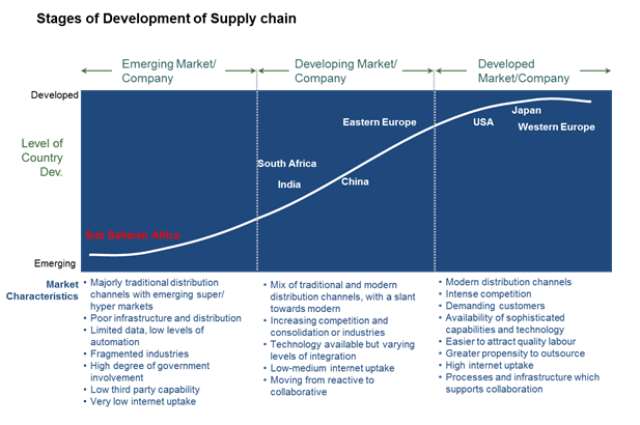

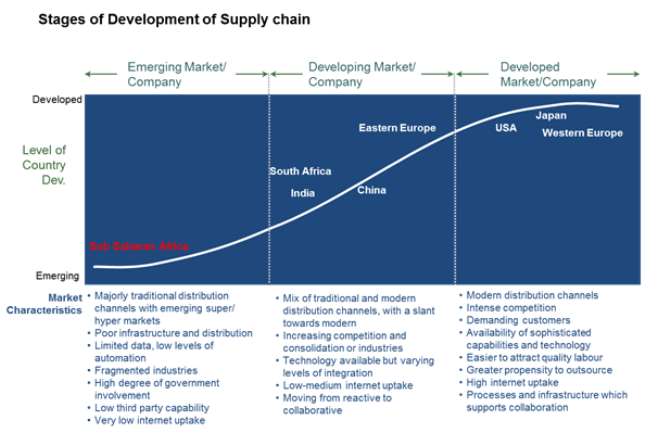

Nigeria like most Sub Saharan Africa countries (except South Africa), is still in the initial stages of supply chain development characterized by poor infrastructure such as poor intermodal transport systems (roads, railway, water, air), and limited data automation.The schematic below shows how Nigeria compares to some select developed countries with respect to supply chain development.

The complexity of the Nigerian supply chain is further compounded by the proliferation of diverse sales channels such as open air markets, moms & pops stores, corner shops, street vendors, “aboki” stalls and formal retail channels.

To truly understand the degree of complexity of the Nigerian distribution model, one can compare with the relatively straight forward formal distribution models operated in the developed countries. Here, after products are manufactured, they are moved directly to retail channels such as supermarkets or open air markets, or to distribution centres and then to the retail channels. The degree of separation between manufacturer and final consumer is small.

So given the complex and challenging nature of the Nigerian supply chain, manufacturers are forced to rely on an intricate web of distributors, sub distributors, stockists, sub stockists, wholesalers, sub wholesalers and retailers to reach consumers.

One obvious drawback is the very limited or almost non-existent flow of information across this supply chain.Consumer purchase information hardly flows back to the manufacturer.Indeed, consumer information that gets to the manufacturer through the supply chain is mostly limited to sales information obtained when they invoice goods to distributors or to the Modern Trade.

This brings up the other strategic question: How can this situation be remedied or improved?

One way of improving visibility of a product’s movement and information flow across the Nigerian supply chain is through the use of a Distributor Management System.

Distributor Management System (DMS):

A DMS consists of 3 main devices. 1) handheld selling devices used by the distributor salesmen for order capture, 2) back end systems that the handheld sales devices link with and the distributor can use to also monitor inventory position, and 3) back end systems that sit with the manufacturer that he can use to monitor the distributors sales and inventory activities.

Without a DMS, a manufacturer has visibility of his product movement and consumer information as far as the distributor (primary sales). With DMS, a manufacturer can extend this visibility as far as the customers of the distributor i.e. sub distributors, wholesalers and even retailers.

Specifically, a manufacturer can enjoy the following improvements upon implementing a DMS such as Newspage improved:

- Visibility into Distributors’ activities& better control of distributor’s business

- Control over warehouses, pricing, promotions & surveys

- Results & Performance reporting

- Visibility into distributors inventory and sales reps performance & Secondary sales data

- Increased sales calls and sales volume

- Market intelligence

- Van-to-Van transfer tracking for field force.